Notifications

20 minutes, 52 seconds

-200 Views 0 Comments 0 Likes 0 Reviews

SharkShop Guide to Improving Your Credit Score in 2025/26

**Unlock Your Financial Future: The SharkShop Guide to Improving Your Credit Score in 2025/26**Welcome to the ultimate roadmap for financial success! As we dive into 2025, building and maintaining a robust credit score has never been more crucial.

Whether you’re aiming for that dream home, planning to finance your education, or simply want better interest rates on loans, understanding the ins and outs of credit can make all the difference. In this comprehensive guide from Sharkshop.biz, we'll equip you with actionable tips and strategies tailored for today’s evolving financial landscape.

Say goodbye to confusion and hello to empowerment as we navigate through proven methods that will not only boost your score but also enhance your overall financial health. Ready to take charge? Let’s swim deeper into the waters of credit improvement!

Credit scores play a pivotal role in our financial lives. They can influence everything from securing that dream home to getting the best rates on loans and credit cards.

In 2025/26, as the economy evolves, understanding how to navigate your credit score has never been more crucial. Whether you're looking to buy a car or simply want peace of mind regarding your finances, knowing where you stand is key.

But what exactly goes into that all-important number? And how can you effectively boost it? As we dive deeper into this guide, you'll discover strategies tailored for today's financial landscape. With insights from Sharkshop.biz we'll equip you with the tools needed not just to improve but also to maintain a healthy credit score moving forward. Let’s embark on this journey together!

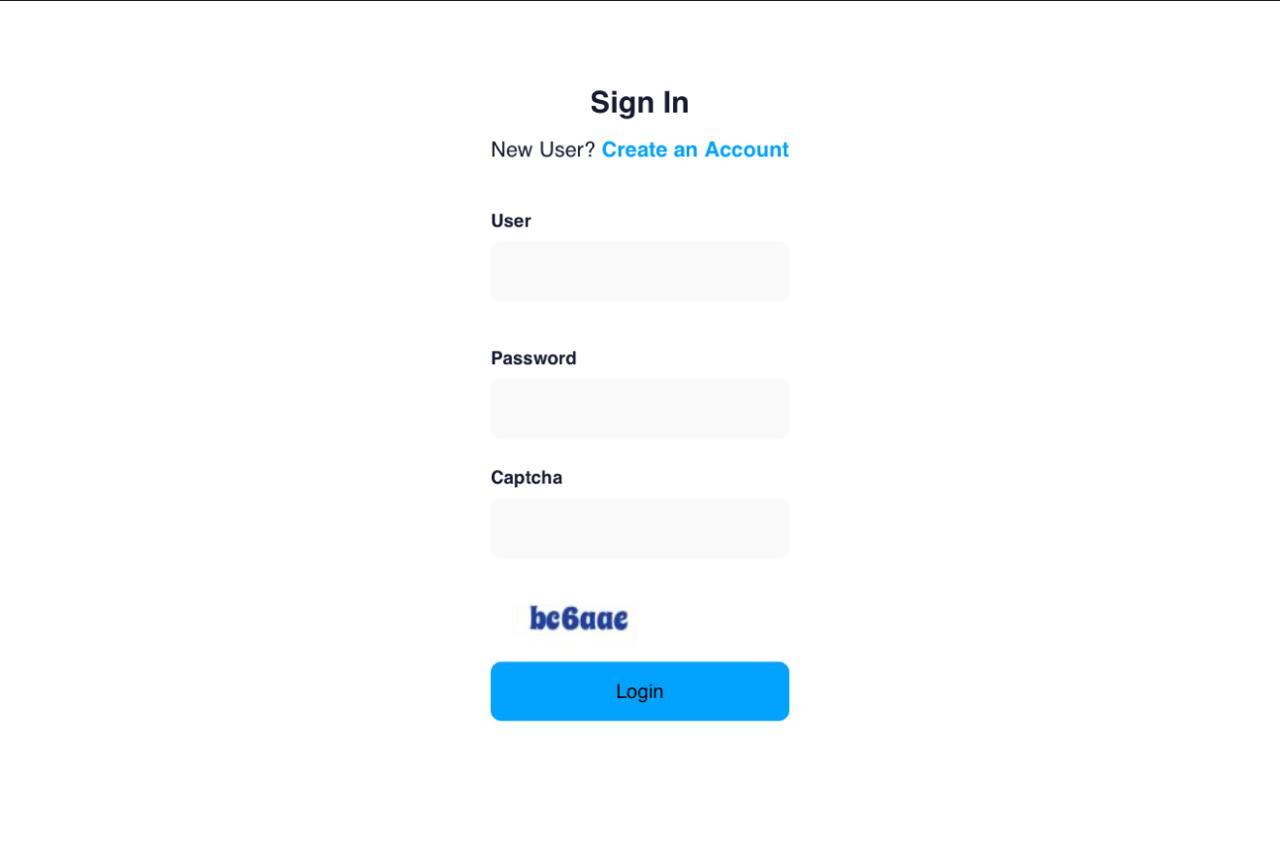

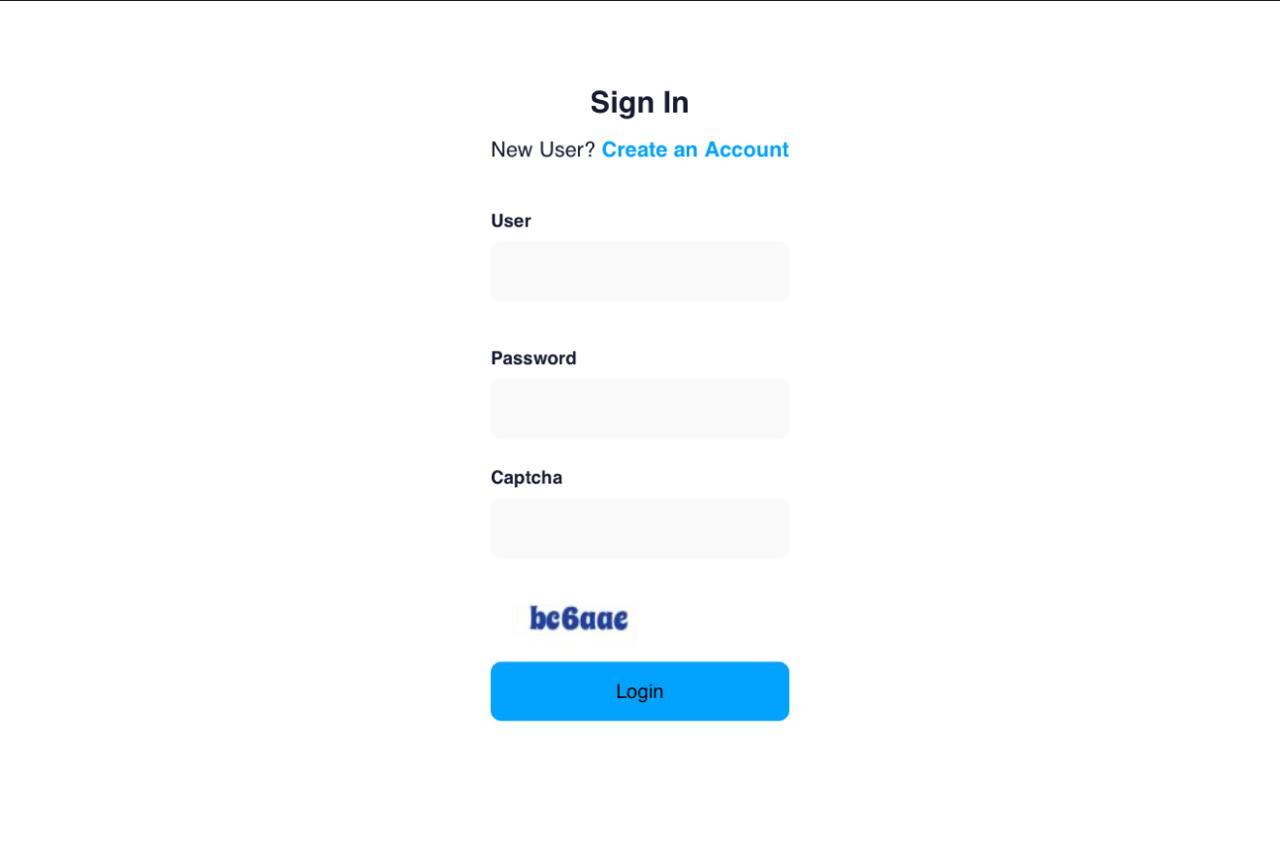

A Screenshot of Sharkshop (Sharkshop.biz) login page

Credit scores are determined by a combination of factors that reveal your creditworthiness. The most significant element is payment history, which accounts for about 35% of your score. Late payments can have a substantial negative impact.

Next up is the amount you owe relative to your total available credit Sharkshop known as the utilization rate. Keeping this under 30% can positively influence your score.

Length of credit history contributes around 15%. Lenders prefer individuals with established records.

The types of credit you use also play a role, making up about 10% of your overall score. A mix of installment loans and revolving credit shows you're financially versatile.

Lastly, new inquiries add another layer to this equation, impacting roughly 10%. Too many applications in a short time may signal risk to lenders. Understanding these elements helps you navigate towards better financial health.

Related: Feshop

Keeping an eye on your credit score is essential. It provides a clear picture of your financial health and can significantly impact your life decisions.

A good credit score opens doors to better loans, lower interest rates, and even rental opportunities. Conversely, a low score may hinder these options.

Regular monitoring helps you spot any unexpected changes or inaccuracies in real-time. Errors can sneak into your report without warning, potentially dragging down your score.

Additionally, tracking your progress over time allows you to see the effects of your efforts in improving it. This awareness keeps you motivated to stick with positive financial habits.

Lastly, knowing where you stand empowers you during negotiations with lenders or landlords. Being informed gives you leverage when discussing terms that suit you best.

Credit scores are influenced by a variety of factors. Understanding these can help you manage and improve your score effectively.

Payment history plays a significant role. Late payments or defaults can severely impact your score, making it crucial to stay on top of due dates.

Your credit utilization ratio is another key element. This reflects how much credit you're using compared to what’s available. Keeping this ratio below 30% shows lenders that you’re responsible with credit management.

The length of your credit history also matters. A longer track record suggests reliability, while new accounts might temporarily lower your average age of accounts.

Lastly, the types of credit you hold matter too. A diverse mix—credit cards, loans—can enhance your profile in the eyes of lenders. Each factor contributes to building a robust financial reputation over time.

Improving your credit score requires a strategic approach. Start by making sure you pay all your bills on time. Even one late payment can negatively impact your score.

Reducing debt is equally important. Aim to lower your utilization rate, ideally keeping it below 30% of your available credit. This shows lenders that you're responsible with borrowing.

Diversifying your credit mix can also boost your score. Consider adding different types of credit, like installment loans or a secured card, as long as they fit within your budget.

Lastly, regularly check for errors on your credit report and dispute any inaccuracies promptly. Mistakes happen more often than you'd think and correcting them can lead to an immediate improvement in your score.

Paying your bills on time is one of the simplest yet most effective ways to improve your credit score. This habit establishes a reliable financial history. Lenders appreciate consistency, and timely payments signal that you are responsible with credit.

Late payments can have a long-lasting impact on your score. Even just one missed payment can drop it significantly—sometimes by as much as 100 points! To avoid this, consider setting up automatic payments or reminders on your phone.

Additionally, creating a budget helps keep track of due dates and amounts owed. A well-planned budget ensures that you allocate funds for bills first before spending in other areas.

Remember, every positive action counts when building better credit health. By prioritizing timely bill payments today, you're laying the groundwork for improved financial opportunities tomorrow.

Reducing debt is pivotal for boosting your credit score. SharkShop login Start by creating a budget that allows you to allocate funds specifically for debt repayment. Prioritize high-interest debts first; this will save you money in the long run.

Your credit utilization rate matters too. This ratio compares your total available credit to the amount you're currently using. Aim to keep it below 30%. If possible, lower it even further, as a healthier utilization rate reflects better on your financial habits.

Consider consolidating smaller debts into one manageable payment with a lower interest rate. This strategy can simplify payments and potentially reduce overall costs.

Another helpful tip? Use cash or debit cards for purchases when possible. It prevents new debt from accumulating while maintaining control over spending habits. Small changes today can lead to significant improvements tomorrow!

A diverse credit mix can significantly enhance your credit score. Lenders appreciate seeing various types of credit accounts. This demonstrates that you can handle multiple financial responsibilities.

Consider adding installment loans, like personal or auto loans, alongside your existing revolving accounts such as credit cards. Each type serves a different purpose in building your profile.

Being strategic is key here. Don’t open accounts just for the sake of variety; ensure they fit into your overall financial plan. It's about balance—having too much debt or taking on unnecessary risk can backfire.

Remember to manage these new accounts responsibly. Timely payments and low utilization rates will keep your score climbing while showcasing your ability to juggle different payment structures effectively.

Your credit report can be a reflection of your financial health, but it's not always perfect. Errors can creep in, affecting your score without you even knowing it. Regularly checking your credit report is essential to catch these discrepancies early.

When you spot an error, take action immediately. File a dispute with the credit reporting agency and provide any necessary documentation to support your claim. This process may seem daunting, but it's vital for maintaining an accurate representation of your financial history.

Remember that each time you check your own report, it doesn’t affect your score—this is known as a soft inquiry. Make it a habit to review at least once a year or whenever you're considering applying for new credit. Staying proactive about errors helps keep surprises at bay when you need to secure loans or other forms of financing down the line.

SharkShop offers tailored services that can significantly enhance your credit score. With personalized financial planning, you receive expert guidance suited to your unique situation. This means actionable steps to improve your credit health.

The resources available through SharkShop help you build solid credit habits. Educational materials and tools are designed to make understanding credit simple and manageable.

Monitoring is crucial in today’s fast-paced world. SharkShop provides effective tools for tracking changes in your score over time. These insights empower you to take charge of your financial future confidently.

If errors appear on your report, quick action is essential. SharkShop's support team aids in disputing inaccuracies efficiently, ensuring your records remain a true reflection of your financial behavior. Embrace these resources and watch as improvement unfolds!

Personalized financial planning is a game changer for anyone looking to improve their credit score. With tailored strategies, you can navigate your unique financial landscape.

At SharkShop, we prioritize understanding your specific needs. This allows us to create a roadmap that aligns with your goals and current situation.

We assess various factors like income, expenses, and existing debt. By doing so, we provide insights that are relevant just for you.

This customized approach not only helps in improving credit scores but also promotes long-term financial health. You gain clarity on how to manage debts effectively while building better habits.

Imagine having a plan that evolves as your life changes—whether it's starting a new job or buying a home. That’s the power of personalized financial planning at SharkShop cc; it grows with you every step of the way!

Building good credit habits is essential for maintaining a healthy score. Numerous resources can guide you on this journey.

Start with online courses offered by financial institutions. These programs often cover the basics of credit management and budgeting strategies. They empower you with knowledge that lasts a lifetime.

Consider using budgeting apps designed to track your spending and saving patterns. Many of these tools come with features that send reminders for upcoming bills, ensuring timely payments.

Books authored by financial experts are another rich resource. Look for titles focused on personal finance and credit building; they offer in-depth insights into effective strategies.

Forums and community groups can also be invaluable. Engaging in discussions allows you to share experiences while learning from others’ journeys towards better credit health.

Exploring SharkShop’s blog provides expert tips tailored specifically for improving your score over time, making it easier to stay informed and motivated.

Monitoring your credit score has never been easier. With the right tools, you can stay informed about where you stand financially and make proactive decisions.

Apps and online platforms offer real-time updates on your credit score. This allows you to track changes immediately and understand how your actions impact your financial health.

Many services provide personalized insights tailored to your spending habits. You’ll receive alerts for bill due dates or potential fraud, helping you safeguard your finances effectively.

Additionally, some tools feature educational resources that break down complex terms into simple language. This empowers you to take charge of improving your credit profile with confidence.

Using these innovative solutions not only helps in monitoring but also offers strategies for growth. They guide users through actionable steps based on individual circumstances, making sure improvement is within reach at all times.

Maintaining a healthy credit score goes beyond just paying bills on time. It's essential to keep an eye on your spending habits. Stick to a budget and resist the temptation of impulse purchases.

Consider becoming an authorized user on someone else's credit card, especially if they have good credit history. This can boost your score by adding their positive payment record to yours.

Avoid closing old accounts, even if you don’t use them. The length of your credit history plays a role in determining your score, so keeping those accounts active helps maintain that longevity.

Be mindful when opening new lines of credit. Each inquiry can impact your score slightly but frequently applying for multiple accounts can raise red flags for lenders.

Lastly, educate yourself continually about financial literacy. Knowledge is power; understanding how different factors affect your score will help you make informed decisions moving forward.

The future of credit scores is poised for change, driven by advancements in technology and evolving financial practices. As we move further into 2025 and beyond,Sharkshop.biz understanding your credit score will become even more crucial.

Fintech innovations are making it easier to access your credit information. Real-time updates and AI-driven tools will help you monitor changes as they happen. This means you'll be able to react quickly if something unexpected impacts your score.

Moreover, lenders are increasingly considering alternative data when evaluating creditworthiness. This shift may open doors for those who previously struggled with traditional scoring methods. It could lead to a more inclusive lending landscape where responsible financial behavior is rewarded, regardless of past mistakes.

As the importance of personal finance education grows, resources like SharkShop will play a vital role in guiding consumers through these transformations. Staying informed about trends can empower you to make better decisions regarding your credit health.

Embracing proactive strategies today positions you favorably for tomorrow's financial opportunities. With dedication and the right tools at hand—like those provided by SharkShop—you can enhance your financial future while maintaining a robust credit profile that withstands whatever changes lie ahead.