Notifications

7 minutes, 18 seconds

-119 Views 0 Comments 0 Likes 0 Reviews

In many parts of rural India, earning a daily wage is more than just hard work — it’s a battle for survival. For countless families, saving money or getting access to a loan from a formal bank is nearly impossible. No collateral. No bank account. No credit history. Just dreams — dreams of sending children to school, building a small house, or starting a local business.

But one financial tool has been quietly transforming these lives, one contribution at a time — the Chit Fund.

A Chit Fund is a community-based savings scheme where a group of people come together to contribute a fixed amount of money every month. One member takes the pooled sum each month through an open auction or a draw. It rotates like this until every member receives their share.

It's simple, accessible, and doesn’t require the mountains of paperwork that banks do. In villages, where banks are often miles away and credit is a distant dream, chit funds bring hope.

Radha, a 32-year-old tailor from a small village in Andhra Pradesh, earns around ₹250 a day stitching clothes. She always wanted to buy her own sewing machine, but saving up felt impossible. Her household expenses swallowed up most of her income.

Then she joined a local Chit Fund. Every month, she contributed ₹500. In the fifth month, her name came up in the draw, and she received ₹5,000 — enough to buy a second-hand sewing machine.

Today, Radha stitches from home, makes more money, and even saves a little for her daughter’s education. “Without the chit fund, I would still be borrowing from the moneylender at double the interest,” she says.

Many rural families are stuck in a cycle of debt, often borrowing from local moneylenders who charge outrageous interest rates. These loans can quickly become a lifelong burden.

Chit Funds offer an alternative — no interest, no harassment, no complex formalities. Just a group of people helping each other, month after month. This model builds trust and a sense of community.

And unlike loans, chit funds encourage a culture of saving. Participants learn the habit of setting aside money regularly — a habit that can completely change financial outcomes.

In many villages, it’s the women who run chit funds. Homemakers, vegetable vendors, artisans — they come together, often after work, to contribute and support one another.

These groups give women a sense of financial control, independence, and voice in household decisions. It’s more than money — it’s empowerment.

Laxmi, a mother of three, used her chit fund payout to buy a cow. Now she sells milk to nearby towns and earns double what she did before. “We started small, but today, we are confident,” she says. “We support each other like family.”

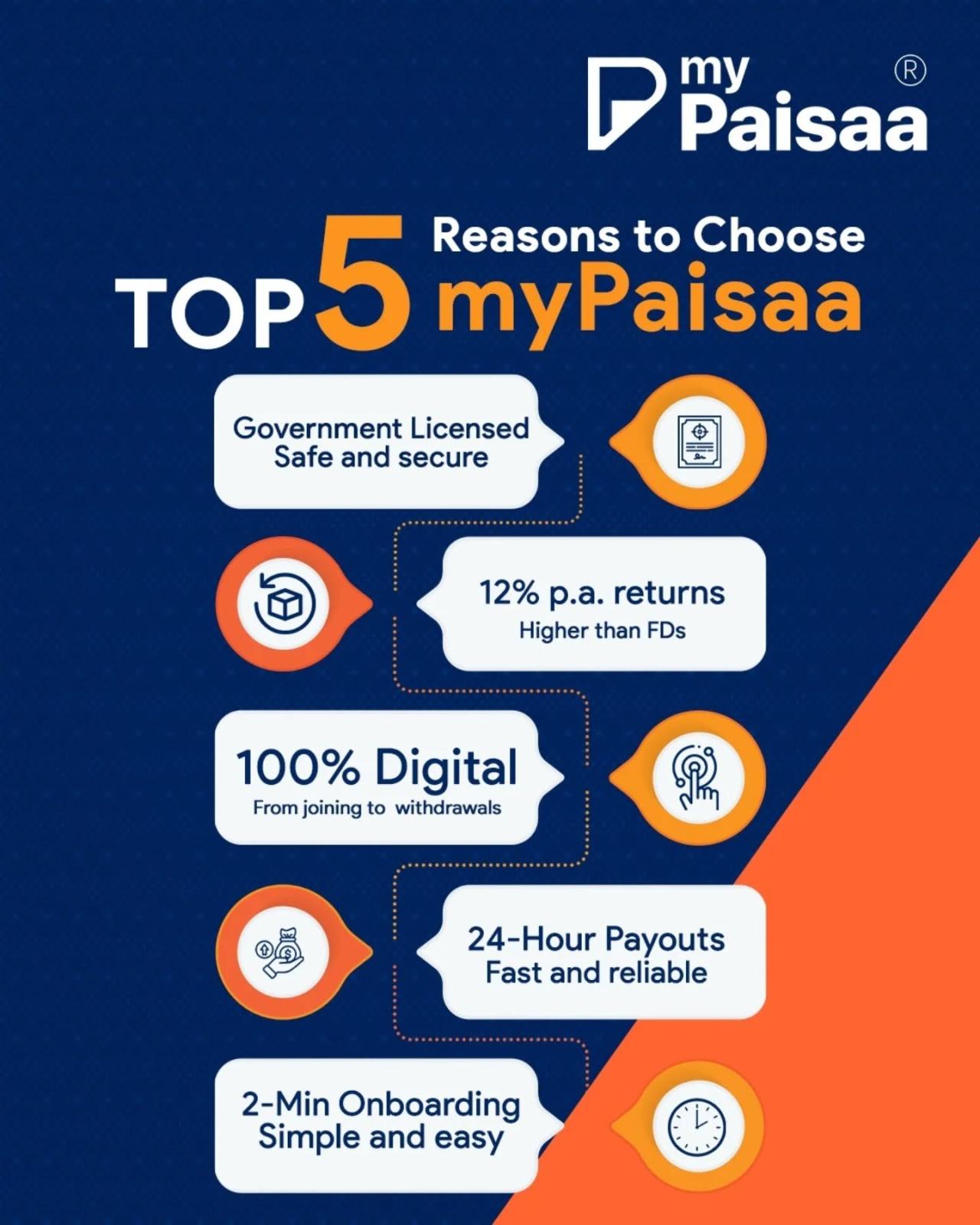

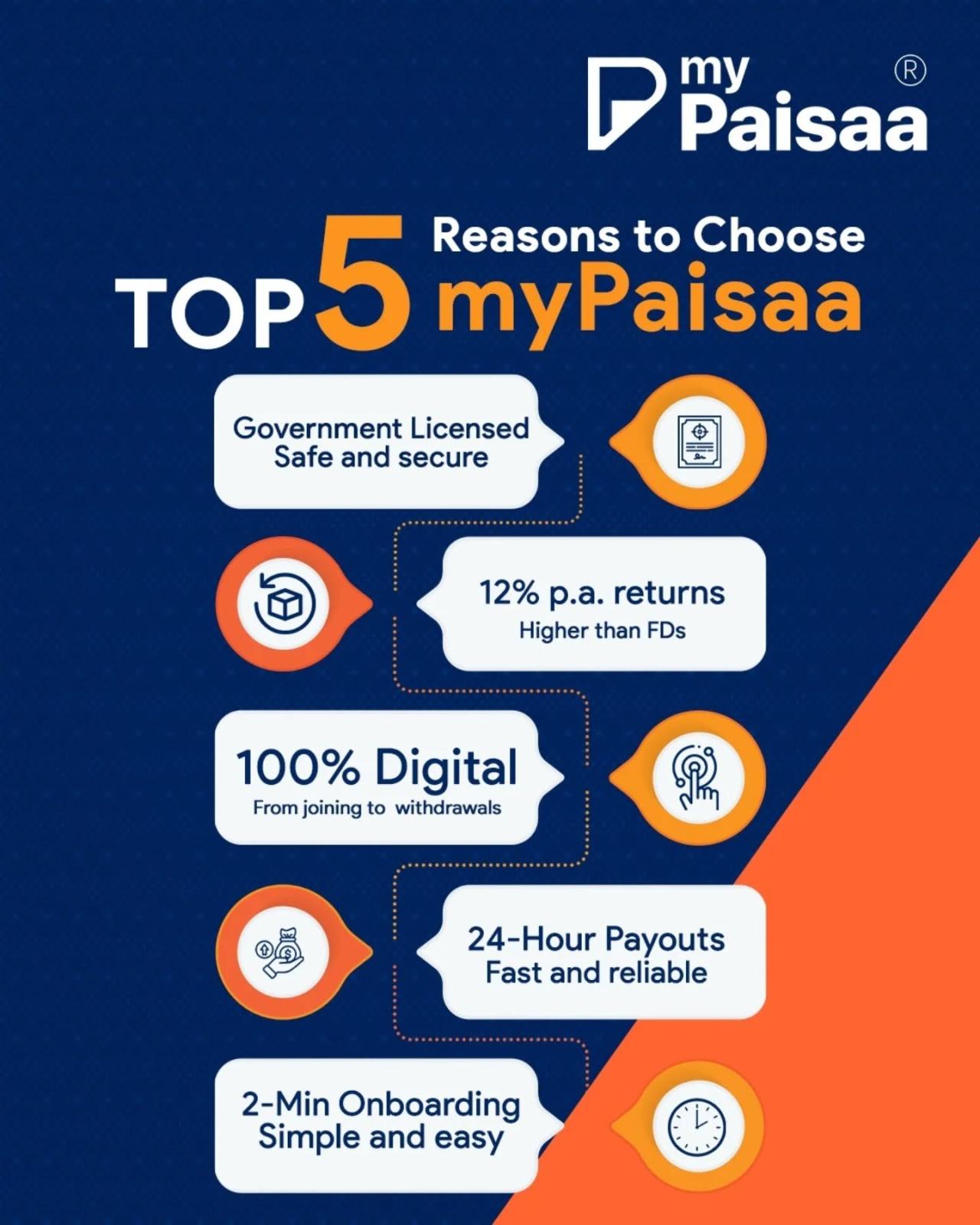

While traditional chit funds still thrive, digital platforms like My Paisaa are bringing this age-old concept into the modern era — with added transparency, security, and convenience.

With My Paisaa, you can join a chit fund from your phone. There’s no need to travel, maintain handwritten records, or worry about trust. Everything is managed digitally. You get reminders, real-time updates, and your money is handled safely.

For rural Indians with smartphones, digital chit funds are a game-changer. No more dependence on informal or unreliable organizers. Technology is helping small dreams take big leaps.

👉 Start your own journey with My Paisaa — download the app, join a chit group, and take your step toward financial freedom.

Chit funds are not just about quick money. They are about planning. About dreams. About dignity.

When a farmer uses his chit fund payout to buy seeds for the next harvest, or a mother uses it to pay her child’s school fee, it’s not just a financial transaction. It’s an investment in hope.

Over time, these small victories build up — better homes, better education, better health. A sense of confidence replaces helplessness.

In rural areas, trust is everything. That’s why chit funds work so well — they are based on mutual respect and accountability. When one member wins the pot, others cheer. When someone struggles, others help.

With digital platforms like My Paisaa, this trust is now supported by secure processes, verified groups, and smart management tools. It blends the warmth of community with the reliability of technology.

Chit funds may not make headlines, but they are quietly changing lives in rural India. They are lifting families out of debt, helping people save, and turning small income into big possibilities.

In a country where many still don’t have access to formal banking, chit funds act as a lifeline — offering not just money, but hope, strength, and a path toward dreams.

So, if you're someone working hard every day and wondering how to turn your earnings into a better future — try a chit fund. Try My Paisaa. And take the first step from daily wages to dreams.

Mypaisaa ChitFund chotasaveplan badasaveplan zyadasaveplan megasaveplan mahasilversaveplan mahagoldsaveplan