Notifications

10 minutes, 37 seconds

-384 Views 0 Comments 0 Likes 0 Reviews

The Water Treatment Chemicals Market is a foundational component of global water purification infrastructure, encompassing chemical agents used to ensure water quality, safety, and regulatory compliance across industrial, municipal, and commercial applications. As global demand for potable water and treated wastewater rises alongside industrial expansion, the water treatment chemicals sector underpins critical processes in energy production, manufacturing, mining, food & beverage, and municipal utilities.

The market’s growth trajectory reflects enduring pressure on freshwater resources, escalating regulatory requirements for effluent standards, and heightened sustainability commitments among both public and private sector stakeholders.

Get the full PDF of the Report:

Includes complete tables, figures, and analytical insights — https://www.databridgemarketresearch.com/reports/global-water-treatment-chemicals-market

The Water Treatment Chemicals Market comprises chemical compounds specifically formulated to remove physical, chemical, and biological contaminants from water. These include flocculants, coagulants, disinfectants, corrosion inhibitors, pH adjusters, scale inhibitors, and other specialty agents. Together, they facilitate processes such as coagulation, oxidation, disinfection, softening, and stabilization.

Types of Chemicals: Flocculants and coagulants, biocides and disinfectants, pH adjusters and softeners, corrosion inhibitors, defoamers, and others

Applications: Raw water treatment, wastewater and effluent processing, cooling and boiler water treatment, desalination support

End-Use Industries: Municipal utilities, energy and power generation, chemical manufacturing, oil & gas, mining, food & beverages, pulp & paper

The market plays a vital role in assuring safe water supplies, minimizing environmental impact, and enabling water reuse in industrial and municipal streams.

The water treatment chemicals industry has evolved from basic disinfection practices to highly engineered chemical solutions designed to meet stringent performance and regulatory criteria. Throughout the early 2000s, industrialization and urbanization propelled demand for chemical additives that could reliably treat diverse water sources.

Innovations in polymer chemistry, antimicrobial agents, and smart dosing technologies have improved treatment efficiency while reducing environmental footprints. Digital monitoring integrated with dosing controls now enables real-time optimization of chemical usage, improving both cost-effectiveness and compliance outcomes.

The shift toward circular water economies and zero-liquid discharge (ZLD) strategies has elevated the importance of advanced treatment chemistries. Water reuse and recycling initiatives in manufacturing and municipal sectors are expanding the role of specialty chemicals beyond conventional purification.

Water Scarcity and Reuse Imperatives: Increasing global water scarcity is driving investments in treatment infrastructure and chemicals that support wastewater recycling and reuse strategies, especially in water-stressed regions.

Regulatory Pressure: Heightened discharge standards and stringent effluent norms push utilities and industries toward advanced treatment chemicals to ensure compliance.

Industrial Expansion: Growth in sectors such as energy, mining, and manufacturing fuels demand for treated process water and wastewater management solutions.

Raw Material Price Volatility: Fluctuations in raw material costs, such as petrochemical feedstocks, can pressure pricing and margins in chemical manufacturing.

Environmental Concerns: Emerging scrutiny over chemical residues and byproducts may limit the use of certain legacy agents, accelerating a shift to greener alternatives.

Green Chemicals and Bio-based Agents: Demand for environmentally benign and sustainable treatment chemistries is rising, creating innovation opportunities for suppliers.

Smart Treatment Platforms: Integration of AI and IoT-based dosing and monitoring capabilities presents a high-value growth frontier.

Complexity of Effluent Streams: As industrial processes evolve, treatment chemicals must address increasingly complex contaminant profiles, requiring specialized formulations.

Infrastructure Gaps in Emerging Economies: Insufficient treatment infrastructure can delay market adoption despite underlying demand.

Sustainability Focus: The industry is witnessing a transition toward low-impact chemistries and eco-friendly formulations to meet sustainability benchmarks.

Digitalization: Automated chemical dosing systems and real-time process controls enable more precise, efficient use of treatment agents.

Regulatory Tailwinds: Policies aimed at improving water quality and limiting harmful discharges are accelerating adoption of advanced chemical solutions.

Ongoing research targets performance enhancement, biodegradability, and integration with advanced membrane and filtration systems to augment overall plant efficiency.

Flocculants and Coagulants: Lead due to necessity in sediment removal and clarification routines.

Biocides and Disinfectants: Essential for microbial control.

Corrosion and Scale Inhibitors: Support longevity and reliability of treatment systems.

Dominant Segment: Flocculants and coagulants often account for sizable market share due to broad applicability across municipal and industrial contexts.

Raw Water Treatment: Vital for potable water production.

Wastewater Treatment: Growing rapidly with emphasis on reuse.

Cooling and Boiler Water Treatment: Important in industrial settings.

The wastewater segment is witnessing accelerated growth as industrial reuse strategies expand.

Municipal Utilities: Large volume demand for safe drinking water.

Industrial Users: Energy, chemicals, mining, and process industries drive customized chemical requirements.

The municipal sector typically dominates due to scale and regulatory insistence on quality.

Direct Supply Agreements with large industrial users

Specialty Chemical Distributors serving regional utilities and SMEs

The choice of distribution varies with customer scale and service requirements.

A mature market supported by advanced infrastructure and strict environmental standards. Utilities and industrial players adopt cutting-edge treatment chemistries for compliance and efficiency.

Strong regulatory frameworks around water quality and sustainability bolster steady demand. Renewable water reuse strategies are also shaping segment growth.

The fastest-growing region, driven by rapid industrialization, urban population growth, and expansive infrastructure investments. Municipal and industrial water treatment projects dominate demand.

Growing industrial base and evolving regulatory landscapes are enhancing market prospects, albeit at moderated growth relative to Asia-Pacific.

Infrastructure development, particularly in water-scarce zones, presents opportunities for specialized chemical solutions.

The market is characterized by a mix of global chemical majors and specialized regional players. Competitive strategies include:

Mergers & Acquisitions: Consolidation to expand product portfolios and geographic reach.

Partnerships: Collaborations with technology providers to integrate digital dosing and monitoring.

Product Innovations: Launches of sustainable, high-performance formulations tailored to specific treatment challenges.

Regional players often focus on niche segments or localized applications, while global firms leverage scale and R&D breadth.

The long-term outlook for the Water Treatment Chemicals Market remains robust. Key prospects include:

Increased Investments: Public and private sectors will continue prioritizing water reuse and treatment infrastructure.

Technological Integration: AI and sensor-based technologies will underpin smarter chemical dosing and optimization.

Regulatory Evolution: Tightening environmental standards will stimulate demand for higher-efficiency, lower-impact chemical agents.

Capital allocation toward sustainable solutions and advanced treatment platforms presents high-growth opportunities for innovators.

The Water Treatment Chemicals Market is experiencing measured yet resilient growth anchored in essential global water management needs. With sustainability, technology, and regulatory compliance at the forefront of market dynamics, chemical suppliers that align with evolving water quality priorities are positioned for long-term relevance and expansion.

What is the Water Treatment Chemicals Market?

A market for chemical agents used in treating water to remove contaminants and improve quality for industrial and municipal use.

What was the market size in 2022?

The market was valued at approximately USD 36 Billion.

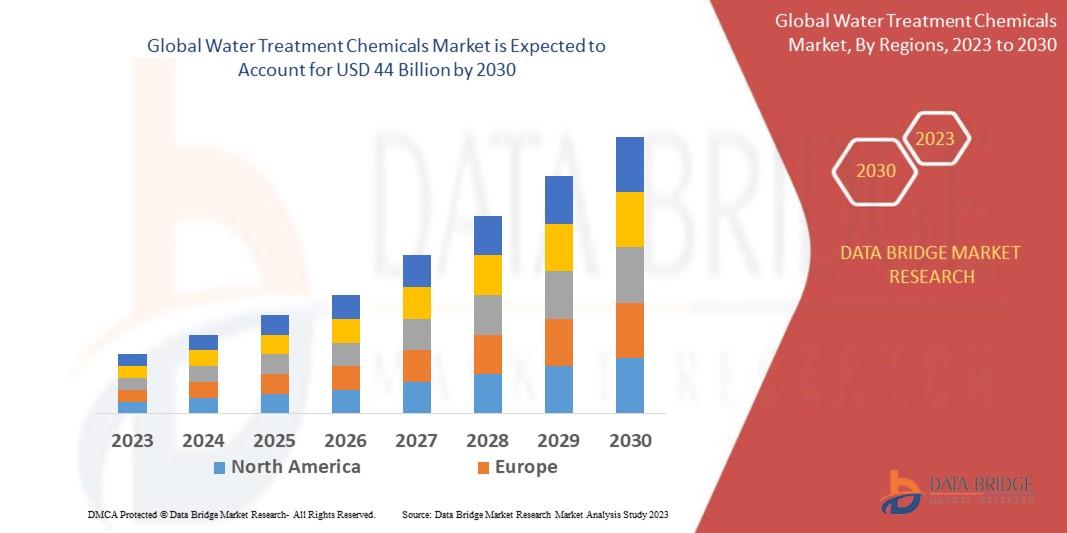

What is the forecast market size by 2030?

The market is projected to reach around USD 44 Billion by 2030.

What is the expected CAGR between 2023 and 2030?

Approximately 3.00 %.

Which chemical types are included?

Flocculants, coagulants, disinfectants, corrosion inhibitors, pH adjusters, and other specialty agents.

Which application segment leads demand?

Municipal water and wastewater treatment applications.

What are the main growth drivers?

Water scarcity, regulatory pressure, and industrial expansion.

Which regions show the fastest growth?

Asia-Pacific leads in growth momentum.

How does regulation impact the market?

Stricter water quality and discharge norms increase demand for advanced treatment chemicals.

What challenges does the market face?

Raw material volatility and environmental impact concerns.

Tags: #watertreatmentchemicals #watertreatmentchemicalslist #typesofwatertreatmentchemicals #watertreatmentchemicalscompanies #top10watertreatmentchemicals #watertreatmentchemicalsmarket #watertreatmentchemicalsinindia #watertreatmentchemicalsmanufacturersinindia #watertreatmentchemicalspdf