Notifications

6 minutes, 59 seconds

-180 Views 0 Comments 0 Likes 0 Reviews

In forex trading, understanding how to calculate position size is vital for managing risk and ensuring that your trading strategy aligns with your financial goals. The lot size calculator serves as a powerful tool in this process, allowing traders to determine the optimal position size for any currency pair based on their account balance, risk tolerance, and trading strategy. This article will break down how to use a lot size calculator effectively and why calculating position size is an integral part of successful trading.

Before diving into the calculation process, it’s essential to understand what lot sizes actually represent. In forex, a lot is a standardized unit of measurement used to indicate the volume of a trade. The three main types of lot sizes include standard lots (100,000 units), mini lots (10,000 units), and micro lots (1,000 units). The choice of lot size affects how much profit or loss a trader can experience per pip movement in the currency pair being traded. Therefore, selecting the appropriate lot size is crucial for risk management and trading efficiency.

Calculating the correct position size is fundamental for effective risk management in trading. Traders must understand the potential consequences of their trades, including how much capital they are willing to risk on each transaction. A common rule in the trading community is to risk only 1-2% of your total account balance on a single trade. By adhering to this guideline, traders can sustain losses without significantly impacting their overall capital. Calculating position size helps ensure that risk is always managed in a consistent manner, laying the foundation for long-term trading success.

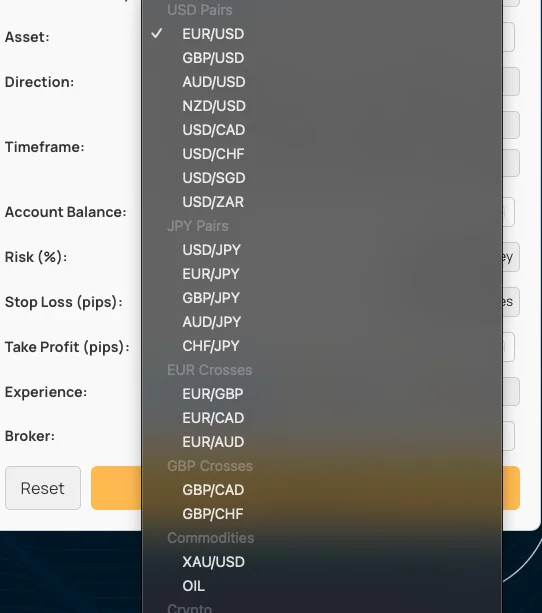

A lot size calculator simplifies the often complex calculations associated with determining position size. To use this tool, a trader typically needs to input several key pieces of information, including the account balance, the percentage of capital to risk, the currency pair being traded, and the distance from the entry point to the stop-loss level in pips. Based on these inputs, the calculator will generate the optimal lot size suitable for that particular trade. This eliminates manual calculations, reduces errors, and speeds up the decision-making process.

Several factors influence the position size calculation, and traders need to consider these variables for accurate results. First and foremost, market volatility is a significant factor. In times of high volatility, traders might opt for smaller lot sizes to mitigate risk exposure. Conversely, during stable market conditions, they may decide to increase their lot size to capitalize on potential profits. Additionally, different currency pairs can have varying pip values, which can significantly affect position size calculations. Understanding these factors ensures that traders are making informed decisions aligned with their overall trading strategy.

To calculate position size for any currency pair using a lot size calculator, you can follow a systematic approach. Begin by determining your total account balance and the percentage you are willing to risk per trade. For example, if your account balance is $10,000 and you are willing to risk 2%, that amounts to $200. Next, identify your stop-loss in pips. If you intend to set a stop-loss 50 pips away from your entry point, you can now input these values into the calculator. Running the numbers through the formula will yield the optimal lot size. This structured approach reduces the likelihood of errors and ensures that your risk remains within acceptable limits.

When trading different currency pairs, it is vital to remember that their characteristics can vary. For example, major currency pairs may exhibit more stability and liquidity than exotic pairs, which can introduce sudden price changes and volatility. Consequently, traders should adjust their position sizes based on the specific characteristics of the pairs they are trading. Using a lot size calculator that allows for easy adjustments based on current market conditions and currency pair characteristics can help traders stay agile and responsive.

Incorporating a lot size calculator into your trading routine supports the development of a comprehensive trading strategy. Knowing how to calculate position sizes helps traders integrate risk management into their overall approach, leading to more disciplined trading behavior. Mathematics plays a crucial role in trading, and using a lot size calculator promotes a systematic approach rather than relying on gut feelings or emotional responses. Over time, consistent application of position size calculation will instill a sense of discipline and confidence, crucial attributes for successful trading.

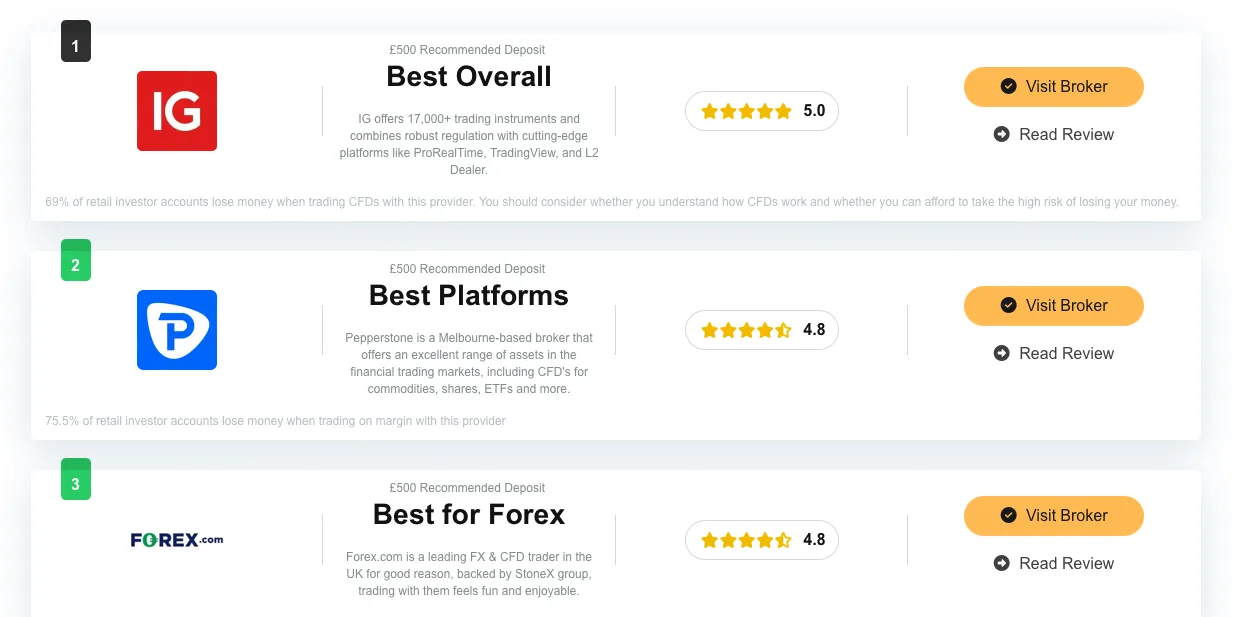

In conclusion, the lot size calculator is an invaluable tool for any forex trader looking to calculate position size effectively for various currency pairs. Understanding and accurately calculating lot sizes based on your risk tolerance and strategy not only enhances risk management but also proves essential to achieving long-term success in the forex market. By mastering the use of a lot size calculator, traders can focus on refining their strategies, making more informed decisions