Notifications

6 minutes, 37 seconds

-579 Views 0 Comments 0 Likes 0 Reviews

Venmo has become a household name for digital payments, offering quick and secure peer-to-peer transfers. From splitting bills to paying rent, it simplifies financial transactions for millions of users. However, understanding the Venmo transaction limit, including the Venmo daily limit and the Venmo weekly transfer limit, is essential for avoiding disruptions in your payment activities. In this guide, we’ll explore all aspects of Venmo’s limits and how to manage them effectively.

Why Does Venmo Have Transaction Limits?

Venmo’s transaction limits are in place for two main reasons:

By setting a Venmo sending limit and other caps, the platform ensures a safe and compliant payment experience for all users.

How to View Your Current Venmo Transaction Limit

It’s easy to check your Venmo transaction limit directly from the app. Here’s how:

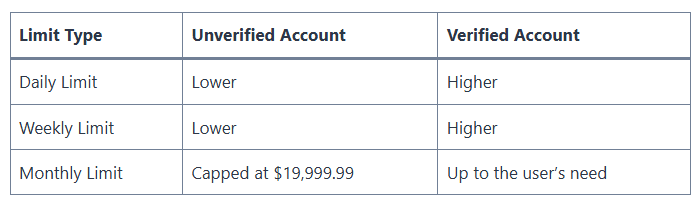

Your transaction limits will depend on whether your account is verified. Verified users enjoy higher limits than unverified accounts.

Steps to Increase Your Venmo Transaction Limit

To increase your Venmo sending limit, you’ll need to complete the account verification process. Follow these steps:

Verification raises your Venmo weekly transfer limit from $299.99 to $4,999.99 for sending payments. Additionally, your Venmo receiving limit and Venmo card limit may also increase.

Venmo’s Key Transaction Limits

1. Venmo Transfer Limit

The Venmo transfer limit for unverified accounts is capped at $299.99 per rolling 7-day period. Verified accounts, however, can send up to $4,999.99 weekly.

2. Venmo Daily Limit

While Venmo doesn’t explicitly set a Venmo daily limit, the platform operates on a rolling weekly system. This means your limits are calculated based on the total amount sent over the past seven days.

3. Venmo Weekly Transfer Limit

Verified users can send up to $4,999.99 per week for personal payments. Merchant payments have a separate limit of $6,999.99 weekly.

4. Venmo Card Limit

If you have a Venmo debit card, the daily spending limit is $3,000. Additionally, you can withdraw up to $400 daily from ATMs.

Common Reasons for Hitting the Venmo Transaction Limit

Several factors can lead to reaching your Venmo limit per day or week:

Tips for Avoiding Venmo Transaction Limits

To manage your Venmo sending limit and avoid disruptions, consider the following tips:

Alternatives to Venmo for Larger Transactions

If Venmo’s limits don’t meet your needs, several other payment platforms offer higher limits:

Exploring these alternatives can help you manage larger transactions effectively.

Conclusion

Understanding and managing your Venmo transfer limit is crucial for a seamless payment experience. By verifying your account, monitoring your spending, and planning your transactions, you can maximize Venmo’s potential while staying within its limits. For larger transactions, consider using alternative platforms that offer higher caps.

Venmo’s security and convenience make it a great tool for everyday transactions, but staying informed about your Venmo daily limit, Venmo weekly transfer limit, and Venmo card limit ensures you can use it without interruptions.