Notifications

7 minutes, 39 seconds

-34 Views 0 Comments 0 Likes 0 Reviews

Market Overview

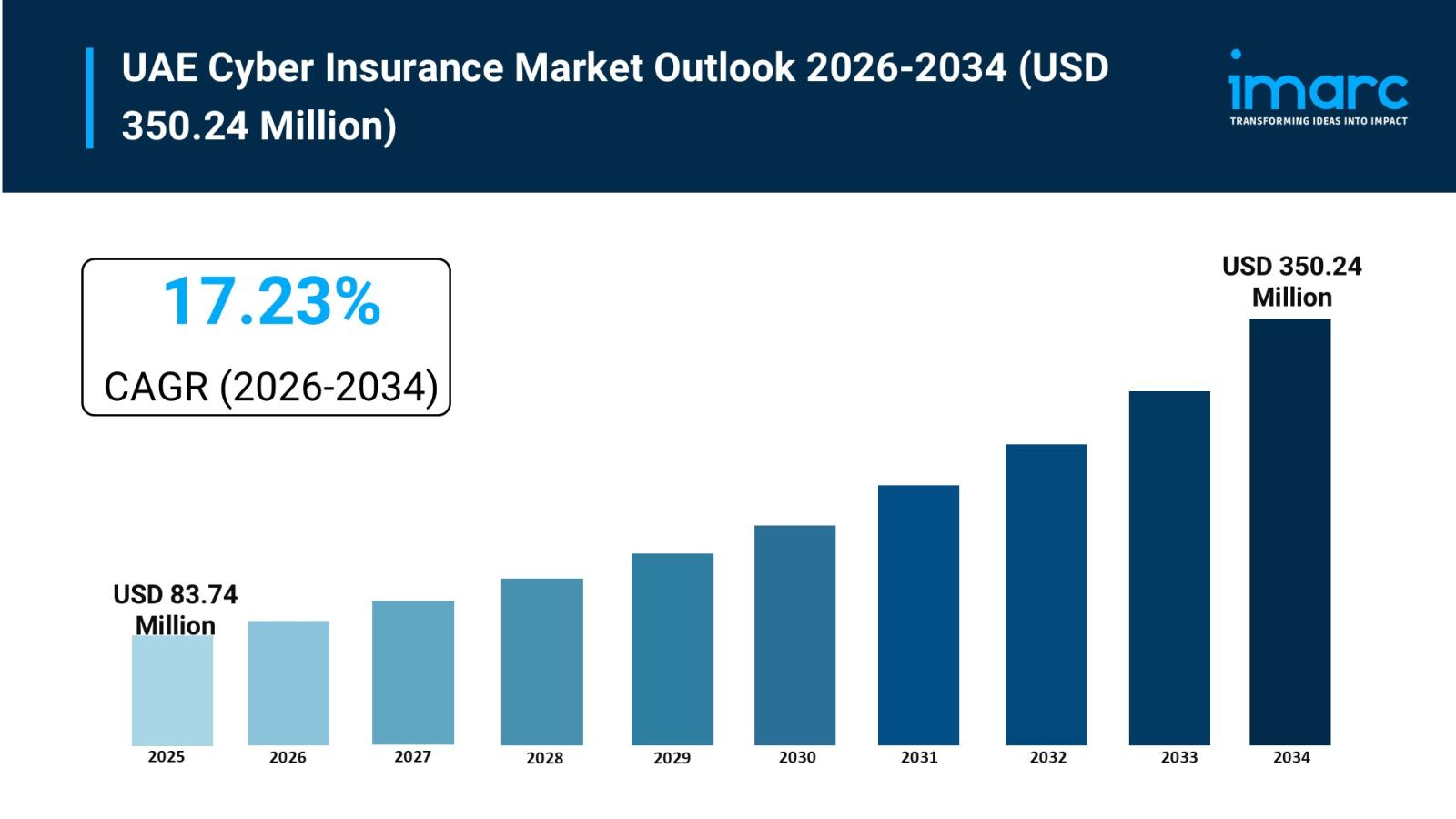

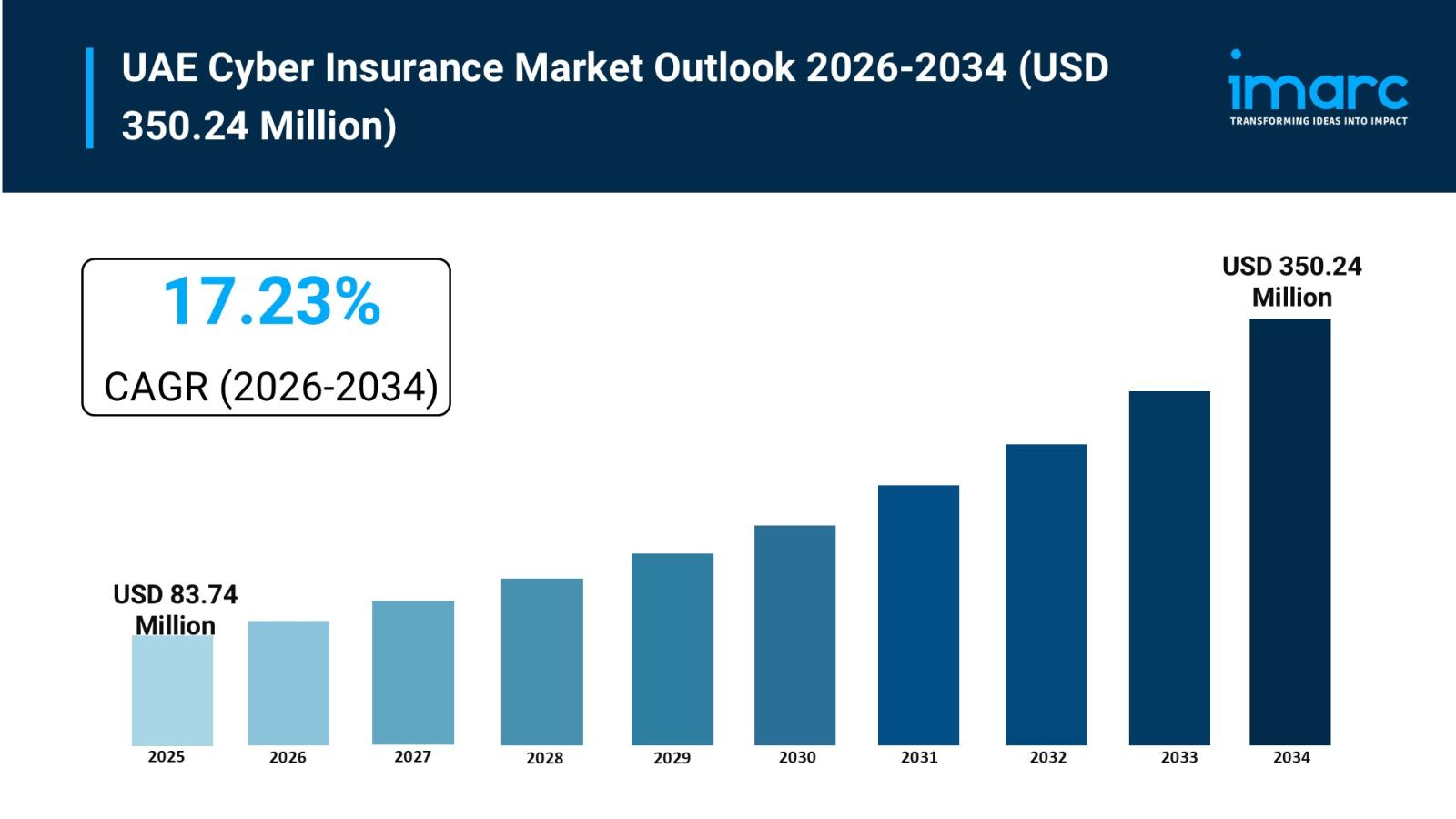

The UAE cyber insurance market size was valued at USD 83.74 Million in 2025 and is projected to reach USD 350.24 Million by 2034, growing at a compound annual growth rate of 17.23% from 2026-2034. This expansion is driven by the increasing frequency of cyber threats, stricter data protection regulations, and rising investments in digital infrastructure. Demand for customized risk coverage is growing across key sectors such as finance, healthcare, and technology.

How AI is Reshaping the Future of UAE Cyber Insurance Market

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-cyber-insurance-market/requestsample

Market Growth Factors

Increased targeted cyber attacks against businesses in the UAE, including ransomware, data breach, business email compromise and phishing attacks have led to a growing demand for specialized cyber risk coverage products in the public and private sectors. In addition, information assurance and other regulations are leading to more stringent requirements on incident response and cybersecurity in the UAE, driving demand and market penetration. Cloud computing and digital payment systems have increased the attack surface of organizations. The entry of startups and SMEs, often uninsured or under-insured, has increased the market. The increased demand for data loss, business interruption and other legal liability coverage has led to dedicated cyber insurers creating specialized insurance products for particular industries and sectors.

The UAE cyber insurance market has been further encouraged by national strategies for artificial intelligence, smart cities and digital banking, all of which stress technology adoption and create exposure to new cyber risks. Broadening investment in digital infrastructure across external and internal domains also supports cover for many different forms of technology such as IoT (Internet of Things) networks, remote workers, and dynamic systems. Policy modularity is increasing in response to requests for cover that matches the risk, and because of pressure from cyber insurance that is bundled into vendor contracts, mergers, and client compliance schemes. Machine learning and other artificial intelligence-based techniques can further improve risk models and enable insurers to manage risk more interactively, for example, through real-time threat analysis or adjusting their products to include new or emerging risks.

The UAE's Vision 2031 was one of the major drivers behind the cyber insurance market growth, as it wants to create a futuristic digital economy. Cyber insurance has become a key component of operational resilience, as corporates in the UAE have started including cyber insurance in their BCP frameworks. There is growing demand by brokers and insurers for service-based, interactive responses to breaches, such as incident response planning and post-breach recovery. In many local markets, insurers bundle products from cyber security companies with their products. The cyber insurance market in the UAE is rapidly evolving as a result of increasing regulation, digital transformation initiatives, greater consumer sophistication and more innovative regional insurers.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=40973&flag=E

Market Segmentation

Component Insights:

Insurance Type Insights:

Organization Size Insights:

End-Use Industry Insights:

Regional Insights:

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Development & News

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302