Notifications

12 minutes, 51 seconds

-347 Views 0 Comments 0 Likes 0 Reviews

Natural rubber is a crucial raw material used in various industries, most notably in the manufacturing of tires, footwear, medical supplies, and numerous other consumer and industrial products. The natural rubber price trend reports is influenced by a wide range of factors, including supply and demand, weather conditions, production costs, global trade policies, and technological advancements. Given the essential role natural rubber plays in the global economy, understanding the price trend is vital for manufacturers, procurement managers, and investors alike. This article provides a comprehensive look at the natural rubber price trend, including the latest market insights, historical trends, and forecasts.

The global natural rubber price trend is influenced by a range of interconnected factors. These include:

Global Supply and Demand: As a commodity, natural rubber prices are directly impacted by changes in demand from key industries, most notably the automotive sector. Demand for rubber is closely tied to the production of tires, and a slowdown in the automotive industry can lead to reduced demand for rubber, pushing prices lower. Conversely, an increase in automobile manufacturing or expansion in other industries using rubber will lead to price hikes.

Weather Conditions and Natural Disasters: Rubber trees are primarily grown in tropical regions like Southeast Asia, and adverse weather conditions—such as droughts, floods, or storms—can severely impact rubber production. In particular, events like floods in Thailand or droughts in Indonesia can lead to lower yields and cause significant price fluctuations.

Production Costs: Labor costs, the cost of raw materials (e.g., fertilizers and pesticides), and energy costs all influence the cost of producing natural rubber. Rising labor or operational costs in key rubber-producing regions like Thailand, Indonesia, and Malaysia can increase the price of rubber. Similarly, the use of more sustainable and efficient production methods can also impact costs.

Global Trade and Tariffs: The global natural rubber market is significantly impacted by trade policies, tariffs, and export restrictions. Key producers like Thailand and Indonesia are major exporters of rubber, and any changes in export regulations or international trade agreements can lead to supply disruptions or price increases.

Exchange Rates: Rubber is traded on global commodity markets, and its price can be affected by exchange rate fluctuations. Since rubber is traded in U.S. dollars, the strength or weakness of the U.S. dollar against other currencies can have a direct effect on rubber prices.

Substitute Materials and Technological Advancements: The development of synthetic rubber as an alternative to natural rubber has also impacted price trends. When the price of natural rubber rises significantly, manufacturers may turn to synthetic alternatives. Conversely, advances in rubber production technology can enhance the efficiency of natural rubber harvesting and processing, potentially reducing costs and stabilizing prices.

Recent developments in the global rubber market have provided insights into how natural rubber prices are likely to behave in the future:

Supply Chain Disruptions: The COVID-19 pandemic disrupted global supply chains, impacting everything from production to logistics. As rubber-producing countries faced lockdowns and restrictions, natural rubber production was limited, which drove up prices. While the market has largely recovered, it remains susceptible to disruptions, such as those caused by political instability or trade tensions.

Environmental Concerns and Sustainability: As the world continues to focus on sustainability, the rubber industry is undergoing changes. There is an increased emphasis on sustainable rubber farming practices to minimize deforestation and preserve biodiversity. These changes may result in higher production costs in the short term but could help stabilize the market in the long term by reducing environmental risks.

Automotive Sector Recovery: With global vehicle production rebounding after the pandemic-induced slowdown, the demand for natural rubber is expected to increase. As automotive manufacturing returns to pre-pandemic levels, particularly in key markets like China and the U.S., the demand for tires and, consequently, natural rubber, is expected to rise.

Energy Prices: Rubber processing involves significant energy consumption, especially in the form of electricity and fuel for transportation. Increases in global energy prices (particularly oil and natural gas) can raise production costs, thereby pushing rubber prices higher. The price of energy, therefore, remains an important factor influencing the price trend of natural rubber.

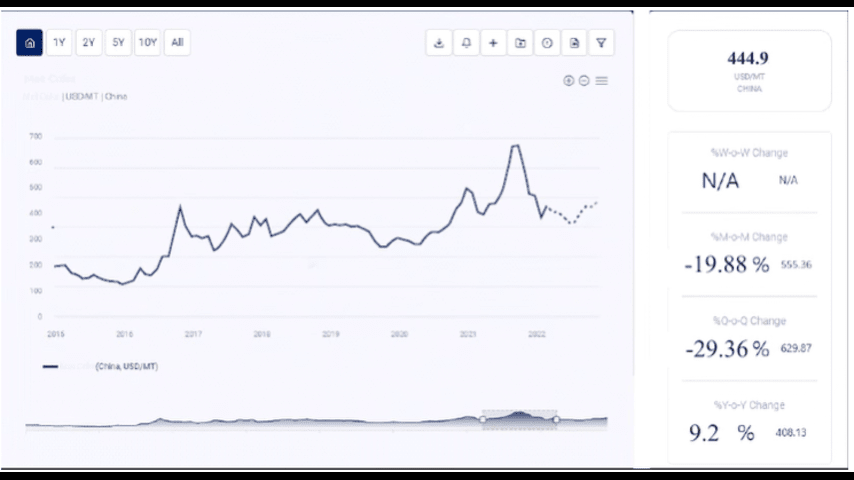

Looking at historical natural rubber price trends helps provide context for understanding current pricing patterns and expectations for the future. The price of natural rubber has exhibited considerable volatility over the years, primarily driven by factors such as supply-demand imbalances, geopolitical tensions, and natural disasters.

2010-2015: During this period, natural rubber prices were relatively high, peaking in 2011 due to strong demand from emerging markets like China and the automotive industry. However, the market experienced a sharp correction between 2013 and 2015, driven by overproduction and a slowdown in demand from key sectors.

2016-2020: Prices began to recover as production declined in major rubber-producing countries, while demand remained steady. However, the COVID-19 pandemic in 2020 led to a sudden drop in demand, resulting in significant price volatility. The pandemic-induced slowdown caused a sharp price drop, but prices rebounded rapidly as global industrial activities resumed.

2021-Present: The global economic recovery post-pandemic has led to an uptick in natural rubber prices, with increasing demand from the automotive industry driving price hikes. However, challenges such as supply chain disruptions, labor shortages, and rising production costs have contributed to continued volatility.

Looking forward, natural rubber price forecasts suggest that the market will continue to experience some fluctuations, but with moderate upward pressure in the medium term. Several key factors will shape the price trend:

Rising Demand from Emerging Markets: As developing economies, particularly in Asia and Africa, continue to expand, demand for natural rubber, particularly in automotive and industrial sectors, will rise. The growing middle class in countries like India and China is expected to increase consumption, putting upward pressure on prices.

Supply Constraints: Rubber production faces natural challenges, including unpredictable weather and limited land availability for rubber plantations. These factors could lead to supply shortages, pushing prices up.

Sustainability and Certification: Increased focus on sustainable farming practices and certifications, such as the Forest Stewardship Council (FSC) certification, could impact production costs. While more sustainable methods may reduce supply in the short term, they could help stabilize prices over the long run by promoting more resilient supply chains.

Technological Advancements in Production: Innovations in rubber production technologies, such as tapping techniques and disease-resistant rubber trees, may help mitigate some of the supply issues and reduce costs in the medium term. However, these technologies may not be widespread enough in the short term to significantly impact the price trend.

Exchange Rate and Geopolitical Risks: The natural rubber market is vulnerable to exchange rate fluctuations and political risks in major producing countries. Any disruption in supply, due to political instability or trade restrictions, could lead to significant price hikes.

Overall, the natural rubber price trend is expected to rise moderately in the coming years, supported by a steady increase in demand and potential supply disruptions. However, price volatility will remain, influenced by both external factors like energy prices and internal factors like crop yields.

Natural rubber prices can differ greatly depending on the region due to varying production costs, supply and demand dynamics, and local economic conditions. Let’s explore how the natural rubber price trend is unfolding across major regions:

As the largest producer of natural rubber, countries like Thailand, Indonesia, and Malaysia dominate the global supply chain. Prices in Southeast Asia are closely tied to global demand from the automotive sector, as well as local weather conditions. The region is also increasingly focused on sustainable production practices, which could impact costs and prices in the future.

India is both a major consumer and producer of natural rubber, particularly in the automotive and tire industries. Prices in India tend to track global trends, though local production challenges, such as labor shortages and weather conditions, can create temporary price fluctuations.

In Europe and North America, natural rubber is primarily consumed in the automotive, manufacturing, and medical sectors. Prices in these regions are influenced by import costs, exchange rates, and changes in local demand from automotive manufacturers.

To stay on top of the real-time natural rubber prices, it is essential to access up-to-date data on market trends. Price fluctuations can happen rapidly, so having access to the most accurate and current pricing data is crucial for businesses looking to make informed decisions.

Request for real-time prices:- https://www.procurementresource.com/resource-center/natural-rubber-price-trends/pricerequest

Effective procurement resources are critical for businesses involved in the rubber industry. Accessing reliable price databases, market trends, and historical data is vital for optimizing procurement strategies and ensuring cost-effective purchasing decisions.

Having access to these resources helps businesses mitigate the risks of price volatility and supply chain disruptions, making it easier to forecast costs and manage inventory effectively.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Natural Rubber Price Trend Reports Natural Rubber Price Natural Rubber Price Trend